Finally, the Bear Market Has Arrived. Here's How to Get Moving and Take Action Right Now

With the S&P500 down more than 20% from its highs and tech companies down much more, the first thing you should do is take a deep breath and analyze your risk.

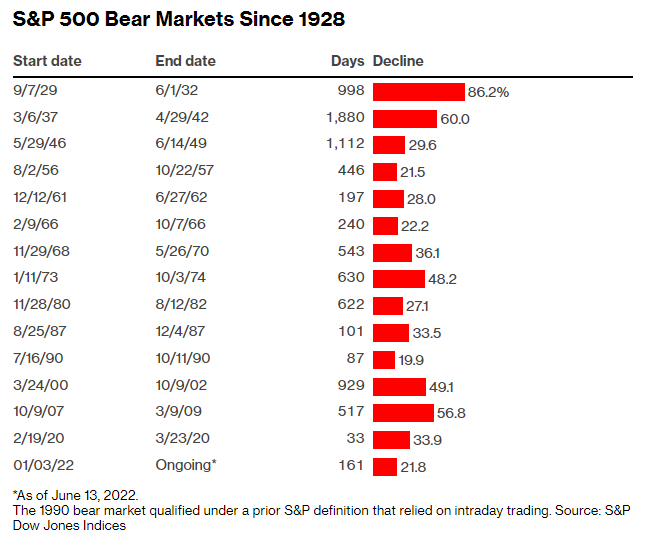

Individual investors require a new playbook—or, at the very least, a tweaked version of an existing one. Early this year, the stock market surge that had been bolstering retirement fund balances faltered, but ultimately came to a halt on June 13. That's when the S&P500 entered a bear market, which is defined as a market that closes at least 20% below its peak.

The 1990 bear market met the S&P's previous definition, which was based on intraday trading. S&P Dow Jones Indices is the source of this information.

But, to be honest, many investors are probably feeling a lot worse than that—and have been for quite some time. Since the S&P's peak on Jan. 3, the handful of megacap tech firms that served as jet fuel for the broader market have fallen even harder, with Meta Platforms down more than 50%, Amazon.com down 39%, and Microsoft, Apple, and Alphabet all losing nearly a quarter of their value. The Nasdaq Composite Index, which is dominated by growth stocks, has been in a bear market since March and is down 32% from its high last year.

When you broaden the scope to include bitcoin, you'll see that there's a lot of suffering out there. Whether we recognize it or not, all of these dips and dislocations might make us more emotional investors.

We experience losses more vividly than we perceive rewards, which is one way emotions influence investing behavior. An S&P500 index fund falling 20% can easily overshadow the fact that the index has still returned over 70% with dividends over the last five years. You don't need to be beating yourself up right now if you've been consistently investing in a balanced portfolio for years. The easiest way to deal with a bear market is to stick to your game plan. If you continue to invest a portion of your income each month, you are now purchasing stocks at a lower cost.

However, your anxiety may serve a useful function if it prompts you to examine the composition of your portfolio and the level of risk it entails. It's a good moment to consider if you're really comfortable with that risk and whether it'll serve you well over a long period of time, not just during bull markets.

Begin by determining whether you have become overly reliant on a single sector or a group of hot stocks. The amount of money invested in tech equities over the last few years has been astounding. Even after the massive drop, the S&P500's top five technology-driven equities still account for more than 20% of the market capitalization-weighted index.

Many investors, particularly those who pick specific stocks, increased their stakes. In the area of behavioral finance, this phenomenon is known as anchoring. They became naturally committed to prominent stocks such as Tesla Inc. that had provided substantial gains for them. "You basically believe the company will only go up, so you lock yourself in and put blinders on," explains Alison Wealth Management's Dave Alison. "People make a tremendous error by not collecting profits along the way, and then they kick themselves when a stock drops 30% or 50%."

When Alison comes into a client in this situation, he may ask them to put a monetary limit on how much of their portfolio they want to be involved with the stock. Every time the value climbs above that, the client agrees to sell and diversify into something new. In theory, when growth stocks continued to rise, investors might have methodically taken profits and invested them in value-style stocks, which had been laggards in the bull market for a long period. "You still engage in the growth approach, but you minimize your risk while accumulating more ballast in value," Alison explains. "Now you have smoother volatility and less excess in any direction." The Vanguard Value ETF has down 9.5 percent this year, while the Vanguard Growth ETF has dropped 32%.

If you still own a lot of tech stocks, you might not want to sell them all now that they're cheaper, but you might want to reduce their weight in your portfolio. Looking ahead, the same reasoning can be applied to the areas that are currently performing well. Energy stocks in the S&P500 have returned more than 50% this year, owing to the supply shock caused by the end of pandemic lockdowns and Russia's assault on Ukraine. Although there's an argument to be made that these once-deep-value stocks still have room to run, increasing exposure to any successful stock requires caution.

Giving up on all-or-nothing decisions is one strategy to manage long-term market uncertainty and reduce volatility. Assume you're debating whether or not to sell a stock. "If you want to be a genius, sell half of your position if you're ever in doubt, or if your brain thinks, 'What if I simply hold this stock for a few more days?,'" says David Wright, co-founder of Sierra Investment Management. "You're a genius if the market recovers because you didn't sell everything, and you're a genius if it continues to fall because you kept half of your holding from falling that far."

Next, it's more crucial than ever to diversify your portfolio. Your portfolio's ballast might still come from a mix of stocks and bonds. But let's be honest: the current situation isn't ideal: Bonds are also losing money in this stock market downturn. Bond prices have been hurt by rising inflation and interest rates, with the Bloomberg US Aggregate bond index down more than 10% so far in 2022, roughly half as much as stocks.

The pain of this may be reduced for investors who own investment-grade bonds directly rather than through a fund because they won't have to look at the current losses. "While the bond portion of your portfolio is down, you have a contractual commitment with the issuer and will receive the entire face value of the bond when it matures," says Atlas Fiduciary Financial financial advisor Laura Mattia. "So your bonds aren't actually down," says the narrator. You'll get the interest you expected and the principle back at maturity, unless there's a default.

Bond fund investors might perceive their current losses more clearly because the fund's return reflects dropping bond market prices. The good news is that, while the prices of bonds in portfolios are falling, their yields are finally rising from record lows. This now increases the case for bonds as a diversifier.

A Series I savings bond from the US Treasury is one sort of fixed-income instrument that provides a very good inflation hedge. Despite the fact that the bonds must be held for at least a year and that you lose three months' worth of interest if you cash them in before five years, the current yield on the bonds, which can be purchased at treasurydirect.gov, is 9.6% —a deal that's difficult to beat these days. The rate fluctuates in lockstep with inflation and is reset every six months. There is, however, a limit on how much you can purchase each year.

Real estate investment trusts, as well as overseas stock and bonds, are other assets that can provide diversification over time. But, once again, none of these have proven to be safe havens against losses in this tumultuous year. The notion is that investing broadly increases your chances of snagging some deals today while also smoothing out future returns. "In the early phases of a bear market, everything is impacted, including diversifiers," says Rob Arnott, co-portfolio manager of the Pimco All Asset Fund and founder of the asset management firm Research Affiliates. "The market eventually starts a sifting process that can be immensely helpful to diversifiers," he says.

Real estate investment trusts, as well as overseas stock and bonds, are other assets that can provide diversification over time. But, once again, none of these have proven to be safe havens against losses in this tumultuous year. The notion is that investing broadly increases your chances of snagging some deals today while also smoothing out future returns. "In the early phases of a bear market, everything is impacted, including diversifiers," says Rob Arnott, co-portfolio manager of the Pimco All Asset Fund and founder of the asset management firm Research Affiliates. "The market eventually starts a sifting process that can be immensely helpful to diversifiers," he says.

Cryptocurrencies were one asset class that was touted as a possible hedge against declining markets and inflation. The reality has been rather different, with tokens trading like risk assets rather than safe havens. Bitcoin has lost 65 percent of its value from its November high, while Ethereum has lost 73 percent. Whatever your opinions on crypto, you should regard of it as a speculative play, similar to an ARK exchange-traded fund on steroids, rather than a diversifier, as a result of this crash.

What about withdrawing your funds in cash? As a timing play, that's a lousy idea—simply it's too difficult for most people, including specialists, to accurately predict when markets will flip. However, the current bad market serves as a reminder that holding a sizable cash reserve is prudent for many people nearing retirement. Without a consistent job, recovering from losses will be far more difficult than it would be for a younger investor, and selling into a declining market could permanently harm a nest egg.

Wealth manager Alison suggests three to six months of liquidity in cash for clients who are still working, but a year's worth of income if they are retired. "Cash" may not always imply "bank money." It could include emergency liquidity provided by a home equity line of credit or the opportunity to borrow against the cash value of permanent life insurance. Alison will occasionally use a client's brokerage account to open a securities line of credit.

High-yield savings accounts, where returns are starting to rise, offer a simpler answer. Marcus, the consumer bank of Goldman Sachs Group Inc., just upped its annual percentage yield to 0.85 percent, and Barclays and Ally Bank offer similar high-yield savings rates. Another option is money market funds, which have interest rates that rise quickly as benchmark rates rise.

Soure: https://www.bloomberg.com/news/articles/2022-06-13/what-to-do-during-a-bear-market-stay-calm?srnd=premium-europe#xj4y7vzkg

Check out our e-books in the Wealth category:

https://wesleyenterprises.groovepages.com/lpwealthebooks

Check out our partner programs in the Wealth category:

https://wesleyenterprises.groovepages.com/lpwealthpartnerprograms